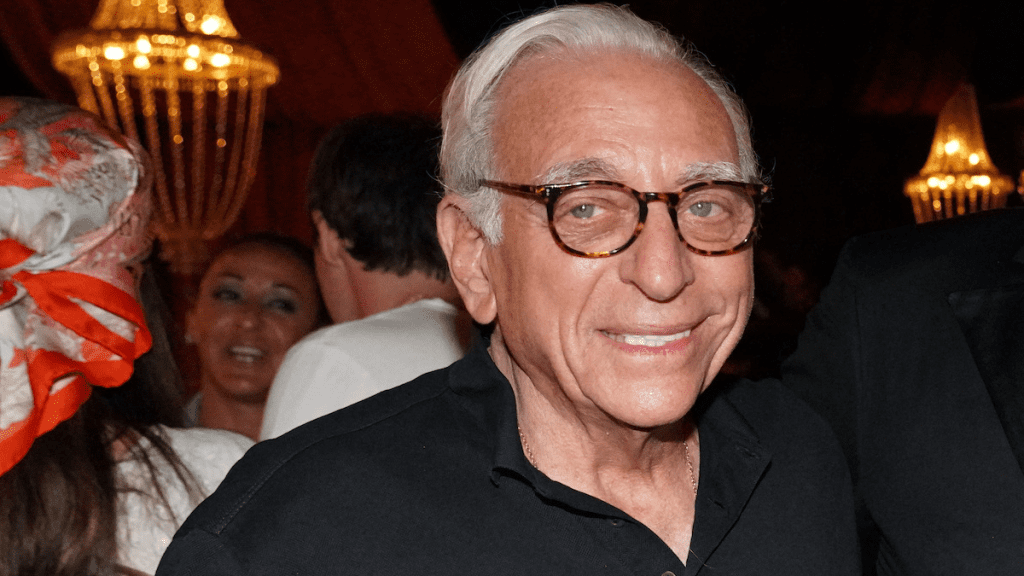

Nelson Peltz’s Trian Fund Management strongly criticized Disney on Wednesday, saying that the company is using a very aggressive and harmful campaign to draw attention away from the mistakes made by the Board.

The statement pointed out that the activist investors really like the entertainment giant and believe it has exceptional assets and opportunities to grow and succeed. It argues that their only goal in the proxy fight is to help Disney and its shareholders.

“Instead of acknowledging our good intentions and previous success, Disney asserts that we have a history of attacking companies and infiltrating boards, and are aiming to cause maximum disruption. Even more dishonest is Disney's claim that our candidates, including Disney's former CFO, are unaware and that our ideas for improving the Company are dangerous and nonsense,” the statement continued. “In our opinion, this charged and insincere language seems designed to divert shareholders' attention from Disney's poor track record and avoid responsibility. Disney's focus on Bob Iger and Ike Perlmutter in this campaign also appears to be an attempt to do the same.”

Trian also accused Disney of manipulating its analysis of the firm’s contributions to portfolio companies, adding that it has delivered 17% average annualized returns for its eleven investments where Peltz joined the board.

The memo comes after Disney released a new presentation to investors on Wednesday, in which it accused Trian of wasting valuable time and resources with its proxy fight, arguing its white paper was filled with false statements and inferences and was widely criticized for lacking substance and being partially plagiarized from other activist presentations.

It also criticized Trian’s “silent partner” Ike Perlmutter, who was let go from the company during its layoffs last year. Disney said Trian “neglected to address Perlmutter’s well-chronicled, difficult history” with CEO Bob Iger and other employees and has said little about his role and influence on the proxy fight.

“It is not credible that Perlmutter is truly just sitting on the sidelines,” it added.

Trian said it does not oppose Iger’s reelection or his continued service as CEO. It also emphasized that Perlmutter is not on the ballot or seeking a board seat and will “not influence the fiduciary responsibilities of our candidates.”

“He owns more than $2.5 billion of Disney stock; he, like all shareholders, wants Disney to improve and create value. The relationship between Mr. Iger and Mr. Perlmutter is irrelevant,” the firm added. “Every drop of ink Disney spills on these subjects appears to be an attempt by the Board to avoid the topic at hand: the need for improved performance at Disney and change in the boardroom.”

It also reiterated that Disney has “significantly underperformed” its potential, its peers and the market and its plans to replace current board members Michael Froman and Maria Elena Lagomasino. It noted that during their tenures, Disney stock has fallen more than 20% and earnings per share have declined.

The message said that Disney was slow to adapt to streaming, paid too much for the Fox acquisition, has low media margins, and is spending a lot of money on the Parks without a clear plan. It also said that the executive compensation at Disney has been misaligned for over a decade and that changes are needed to improve performance for shareholders in the future.

Trian criticized J.P. Morgan and ValueAct Capital for supporting Disney.

J.P. Morgan and ValueAct, who work with Disney, did not talk about Mr. Froman, Ms. Lagomasino or Disney’s other non-management directors. Trian is concerned about how much money these firms are being paid and thinks that Disney cannot convince them or other shareholders that it is doing well.

Peltz and former Disney chief financial officer Jay Rasulo will stand for election at the company’s annual shareholder meeting on April 3.

More information will be provided later.