Of all the big established companies, Paramount Global is the most impacted by changes in the media and entertainment industry. It's facing major challenges in an already struggling industry, and there may not be another company in as difficult a situation as Shari Redstone’s media empire. as Shari Redstone’s media empire is also facing major challenges.

Paramount Global is dealing with an unprofitable direct-to-consumer segment, a declining studio operation, and reliance on linear TV, which outweigh its strengths such as owning a valuable TV library and the NFL rights for another decade. The absence of revenue from theme parks, like Disney and Universal have, is also a drawback.

Paramount is in a tough spot: Should it team up with a bigger company or break up, selling its different assets one by one and becoming a content provider to other platforms in a competitive streaming industry? And what would be the role of its streaming service, Paramount+, in any of these scenarios?

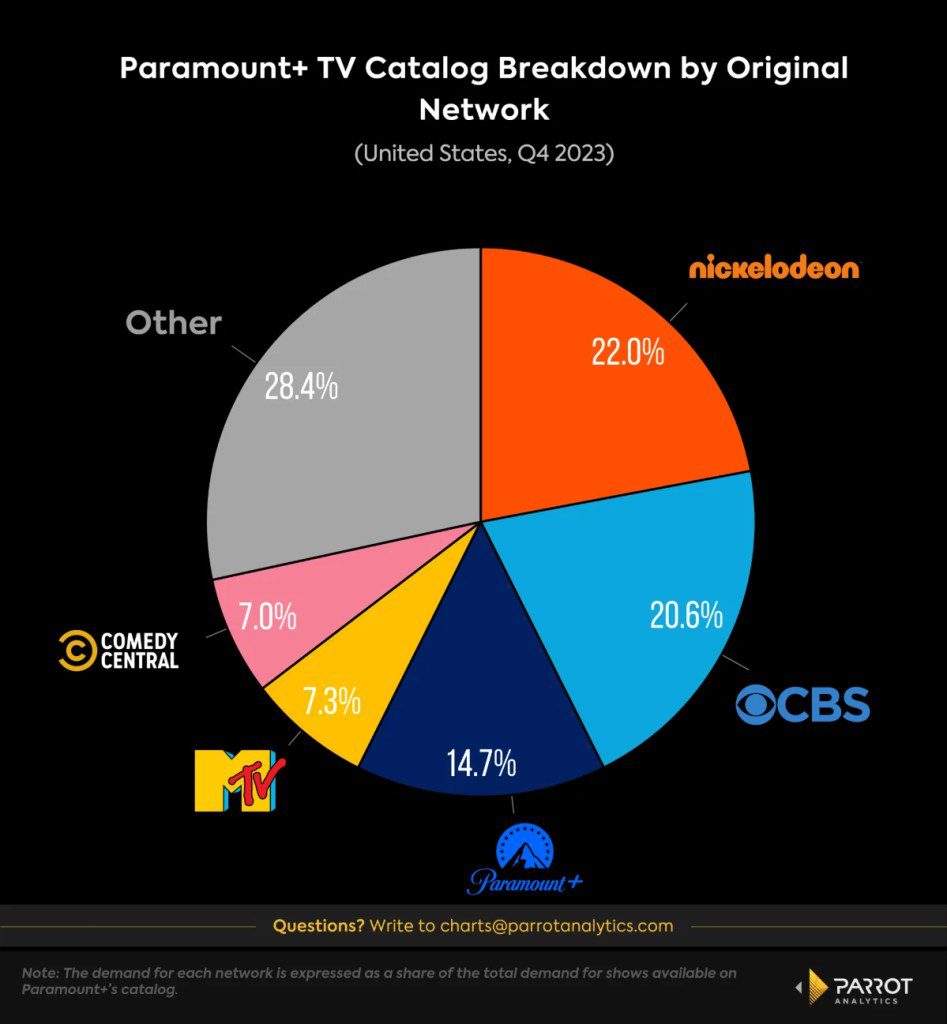

Paramount+ relies heavily on content from its own networks. Nickelodeon, CBS, MTV, and Comedy Central are responsible for about one-third of the total demand for Paramount+ TV content. CBS shows make up more than a fifth of on-platform demand, mainly featuring popular and rewatchable procedurals like “Hawaii Five-0,” “NCIS,” “Criminal Minds,” and “Blue Bloods.”

This breakdown reveals the platform’s exposure to declining linear TV. Paramount+ has successful original content, especially in the Star Trek and Taylor Sheridan franchises, but these are not yet sufficient to significantly boost the platform’s TV content. Original shows account for 14.7% of the on-platform TV demand, showing that they cannot solely support the streaming service.

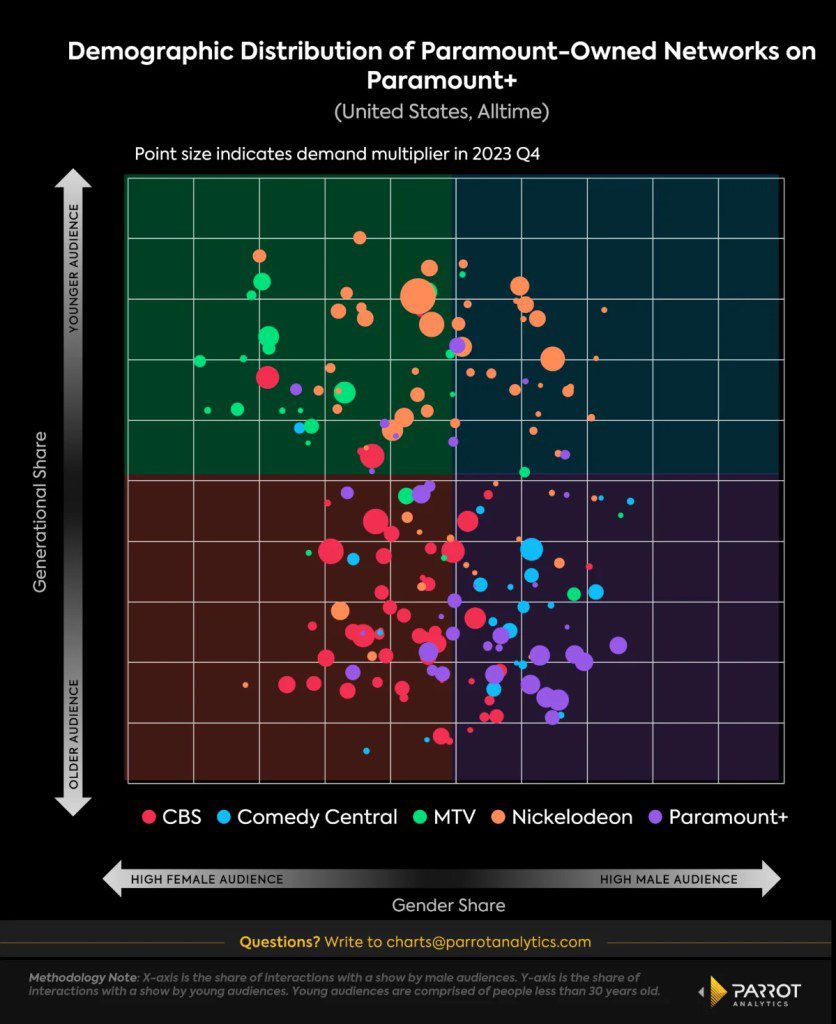

Paramount+ benefits greatly from having access to titles from networks under Paramount Global’s ownership, providing a wide-ranging library. Each network serves a different audience.

Analysis of the platform’s demographic distribution indicates that CBS originals appeal more to older and female audiences, with a few exceptions. “Criminal Minds” and “Big Brother” are popular among younger audiences, while “Blue Bloods” and “48 Hours” attract predominantly male viewers. On the other hand, Comedy Central shows appeal more to older male viewers. Paramount+ originals tend to attract older viewers of both genders.

MTV titles cater to younger female audiences on the platform, due to the network’s focus on reality TV. Particularly, “The Challenge” and “Jersey Shore: Family Vacation” were the most in-demand MTV shows on Paramount+ last quarter. For even younger audiences, Nickelodeon offers popular animations such as “Avatar: The Last Airbender” and “The Loud House.”

This diverse library is a key asset for Paramount as a content provider. In a streaming environment dominated by platforms owned by tech giants, sections of Paramount’s library could attract numerous potential buyers seeking to enrich their streaming services with greater financial resources.

Daniel Quinaud works as a senior data analyst at Parrot Analytics, a partner of WrapPRO. For additional content from Parrot Analytics, check out their website. visit the Data and Analysis Hub.