Could Kevin Bacon have saved us from the 2008 financial crisis? Probably not. But the network science behind six degrees of Kevin Bacon just well may have.

According to the famous saying, every movie actor is separated from Kevin Bacon by six degrees of separation or less, going from co-star to co-star (actually most are separated from Bacon by only three degrees). Actors form a “small-world” network, meaning it takes a surprisingly small number of connections to get from any one member to any other. Natural and man-made small-world networks of all kinds are extremely common: The electric power grid of the western United States, the neural network of the nematode worm C. elegans, the Internet, protein and gene networks in biology, citations in scientific papers, and most social networks are small.

Most of these small networks use hubs, or nodes with an especially large number of links to other nodes. Kevin Bacon is a hub, because he’s starred in so many movies. The RMG neuron in C. elegans’ tiny brain is also a hub and coordinates its social behaviors (such as they are). Hubs make small-worlds small by supplying shortcuts between otherwise distant nodes. And that can be a very good thing.

After the 1978 Airline Deregulation Act phased out government control, for example, airlines moved to hub-and-spokes flight routing. Airfares went down and occupied seats rose from 50 to 85 percent of the total. When Lowe’s hardware stores switched to a hub-and-spoke distribution system in the early ’90s—by creating one 30-football-field-big center to serve every hundred or so of its stores—it cut distribution costs by between 40 and 50 percent.

Unless you’re an aficionado of finance, I’ll bet that you haven’t heard the words “topology” and “2008 financial crisis” in the same sentence.

This efficiency comes from the way small networks consolidate complex operations. Links can be expensive to build and maintain, and small networks have fewer of them. Networks based on hubs and spokes are also simple, and robust against random node failures—since most nodes are not hubs and therefore not so crucial to the network’s operation.

Which brings us back to Kevin Bacon and 2008. You’d think that, if you were designing a really important network, like, say, the global financial system, you’d want to use a small-world network, with a very small number of hubs. That is not, however, what our financial networks looked like—until recently.

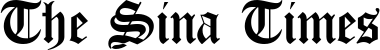

In 2013, then Vice-Chair of the Federal Reserve Janet Yellen showed what looked like a tangled ball of yarn to a roomful of economists1:

The messy-looking figure represented the credit default swap (CDS) market network, and looked like too many cords crammed into too small a drawer. The tangle results from the way banks have traditionally traded which each other, called OTC for “over-the-counter”: directly, freely, whenever, and however they wished. It’s the way most derivatives have been bought and sold since the 1970s, when a boom in derivatives made them the world’s largest market. Today, far more money flows through the financial system from derivatives trading than from all the world’s stock and bond markets combined.2,3,4

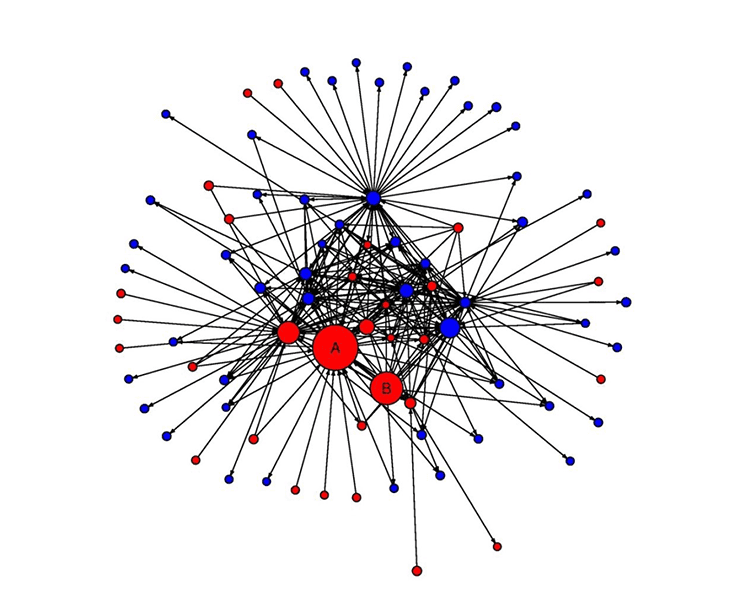

Yellen took issue with her ball of yarn’s tangles. If the CDS network were reconfigured to a hub-and-spoke shape, Yellen said, it would be safer—and this has been, in fact, one thrust of post-crisis financial regulation. The efficiency and simplicity of Kevin Bacon and Lowe’s Hardware is being imposed on global derivative trading.

In the wake of the crisis in September 2009, the leaders of the G20 (the main economic council of developed nations) met in Pittsburgh and acted to impose hub-and-spoke networks.5 They agreed to impose something called the “clearing mandate” on the OTC derivative market—a regulation meant to make the financial system safer by making hubs and spokes mandatory. The mandate works by requiring that all standard OTC derivatives be traded on exchanges and cleared through central clearing counterparties, or CCPs. CCPs are simply companies that stand between the buyers and sellers of derivatives. In 2010, the Dodd-Frank law codified this requirement in the U.S. Other countries have since followed suit. Now, in contrast to the free-for-all that dominated derivative trading before, most of the time, when Bank A wants to buy derivative X from Bank B, B must first sell X to a CCP, which then turns around and sells X to A.

And that requirement takes the CDS network in Yellen’s first picture, and combs it out to the tidy hub and spoke of her second, with the CCP at the hub.

Implementation of the mandate is still a work in progress, but mostly it’s a done deal. Interest rate derivatives comprise nearly 80 percent of the OTC market and now, because of the mandate, CCPs like CME Clearing in the U.S. and LCH Clearnet’s Swapclear in Europe are clearing 70 percent of the interest rate derivatives traded each week.6 Credit derivatives are even further along, at 79 percent. Yellen considers this progress toward making the system safer.

But is it?

The idea that a financial network’s shape (or topology) can be a crucial contributor to financial contagion and to systemic risk is relatively new, and not necessarily obvious. In fact, unless you’re an aficionado of finance, I’ll bet that you haven’t heard the words “topology” and “2008 financial crisis” in the same sentence.

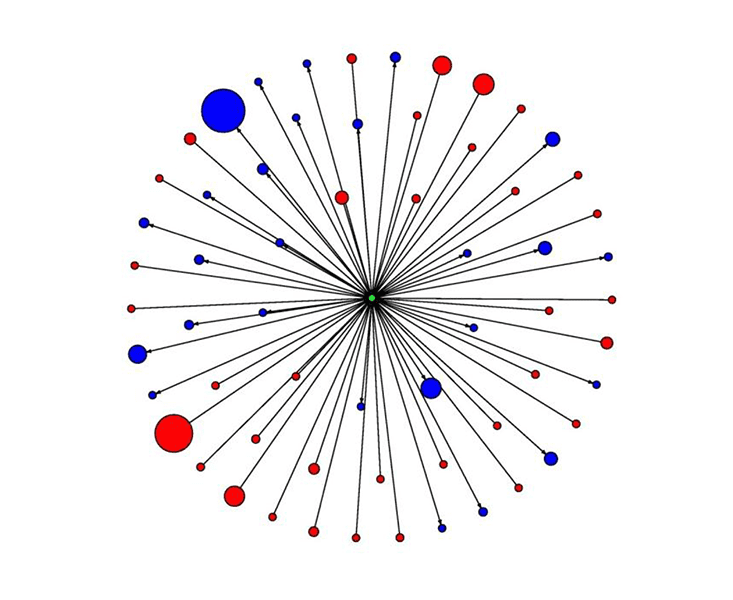

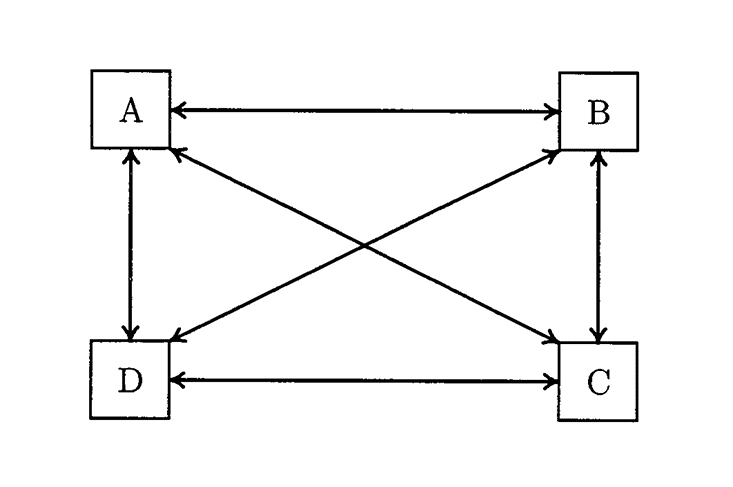

Think of topology as the mathematical subtext to 2008. Just as there are dangerous lending practices, there are dangerous topologies. This one, for example:

The four banks in this network (and the amounts they owe) are identical: Each has the same amount of capital, meaning the same capacity for loss before it goes bankrupt. You can think of capital as being a bank’s fuel: The amount of money that can be taken from its tank before its gears grind to a halt.

Now, imagine Bank A loses a bunch of money, enough that it goes bankrupt and can’t pay all of what it owes to B. In that case, B suffers a loss too. And if B’s loss is greater than its capital, it will also go down. If A and B together lose enough, then C will fail too. Finally, a loss, or leak, big enough to drain the sum total of all the capital that all the banks in the network have will take the whole system down.

Now contrast that with what happens in the following network:

The banks themselves are the same as before: They all have the same capital and the same debt. The only thing that’s changed is the network’s topology: who’s borrowing from whom and how much. This time all the banks have spread their borrowing and lending around, making the network more connected. Bank A, for example, has the same debt as before but this time it owes a third of it each to B, C, and D.

So again imagine A springs a leak, so that a certain amount of fiscal fluid drains out of the system. The difference this time is that A’s deficit (the difference between what it owes and what it can pay) is divided equally between banks B, C, and D. Therefore each of B, C, and D suffers just one-third of the loss B did before. And that means that A must have a deficit three times bigger than before to take down another bank. This second network’s more connected topology enables it to absorb a bigger shock than its ring-shaped relative.

A big reason credit markets froze-up in 2008 was simply confusion about who was exposed to whom.

These four-bank network examples come from an influential paper written in 2000 by economists Franklin Allen and Douglas Gale.7 Their model and analysis was much more sophisticated than what I’ve described here, but they come to the same conclusion: The more connected a financial network is, the more robust it is, meaning it takes a bigger shock to trigger a sequence of bank failures.

On the other hand, this little four-bank model also illustrates an alarming feature of highly connected networks. As Allen and Gale pointed out in their paper, a loss big enough to drain all four banks’ capital will bring down the fully-connected network just as surely as it will bring down the ring-shaped one. The difference is that, while the ring network fails one bank at a time, the fully connected one fails suddenly and all at once. This is what the Bank of England’s chief economist and executive director, Andrew Haldane, calls the “robust yet fragile” property of highly connected networks.8

In fact, Haldane says, the actual financial network’s highly connected nature “sowed the seeds” of the last crisis. But how do we know that the hub-and-spoke solution that both Haldane and Yellen support doesn’t reduce one type of danger at the expense of unintended consequences that could be even more dangerous?

This being a question of economics, it’s not hard to find experts who think that’s exactly the case.

I happened to get University of Houston finance professor Craig Pirrong on the phone a few minutes after seeing him live on Bloomberg TV, where he’d said “no” when asked whether CCPs were making the system more sound.

“That’s right, yeah,” he said when I reminded him. “Sometimes I feel like I should talk about this next to a campfire with a flashlight under my chin.”

CCPs are supposed to reduce credit risk by reducing the total amount of exposure creditors have to debtors from derivative trading. Imagine, for example, that, due to derivatives, each bank in the ring-shaped four-bank network we looked at before owed the next $100 million. Then the grand total credit exposure in the system would be $400 million, since that’s the total amount of cash that creditors have at risk. On the other hand, if all the banks traded with each other through a CCP, then, since each bank would both owe the CCP $100 million and be owed by the CCP $100 million, the two debts would cancel and net to zero. The grand total credit exposure in the system would also therefore be zero.

In more realistic scenarios, a CCP won’t reduce the system’s credit exposure to zero, but the hub and spoke shape it creates will still reduce it. It does this by funneling the system’s debts through fewer links in the network, providing more opportunity for netting. This is similar to the airline case where hub-and-spoke routing reduces the number of routes, providing more opportunity for passengers to share flights. In that case, the benefit is fewer empty seats. In the financial case, the benefit is lower credit exposure. That exposure was recently estimated by the Bank of International Settlements to be $2.9 trillion, down from $5 trillion at the end of 2008, in part because of CCPs.

“We’re still a little bit in the stone age of mapping out financial networks. That’s the really frightening part.”

Hubs-and-spokes’ simple shape—their small numbers of connections and routes, their easily intelligible flows—also promotes transparency, which itself reduces risk. A big reason credit markets froze-up in 2008 was simply confusion about who was exposed to whom. As Stanford professor of finance and derivative expert Darrell Duffie said to me, mimicking the mindset of bankers in the run-up to Lehman’s demise, “Gosh, if Lehman failed, who else connected to Lehman might fail? And who am I connected to that might be connected to Lehman that might fail? Gosh, this is really complicated. I think I’m just going to stop providing credit.”

Shippers, retailers, and airlines benefit from hubs and spokes for similar reasons. Airlines have fewer routes to keep track of. Fast-food chains have an easier time tracking down the source of salmonella and other contaminants.

In fact, said Duffie, about regulators’ and politicians’ enthusiasm for the clearing mandate, “It wasn’t so much that people were confident that it was going to reduce risk. It was basically a way to create more transparency, and to be more confident about the kinds of risk that we actually face.”

Big banks have long served as hubs in the financial network, helping to make it small. The difference with CCPs is that there are fewer of them than big banks, so that they’re making a small world even smaller. Plus, CCPs have the virtue of doing one and only one thing: standing between the two sides of trades. They are much simpler and more transparent than banks and, as Duffie points out, “The CCP can’t lend money to Argentina, or to real estate developments in Arizona, whereas banks can. It has no discretion to take risk.”

And yet, there are those who aren’t convinced.

When I put the argument that CCPs will not engage in risky behavior in front of Franklin Allen, who is more skeptical of their contribution to safety than Duffie, he pushed back. “I disagree with that,” he said, “because if you look at these derivatives scandals like Nick Leeson and Barings and so on, it’s very difficult to control these risks, so when fraud and things are involved, it’s just that things don’t work very well. Then you get the potential for these catastrophic failures.”

Pirrong’s point of view is that the regulators are just moving risk around rather than reducing it. “You just basically squeeze the balloon at one end and it just pops out the other,” he told me, summarizing what he considers to be the clearing mandate’s most concerning trade-off: that between total credit risk (which CCPs should reduce) and the “liquidity risk” that CCPs may actually increase.

Liquidity in finance means access to cash, or assets easily sold for cash. Liquidity risk is the danger of not having liquidity when you need it. CCPs could exacerbate a liquidity crunch during a crisis because of the way they protect themselves from bank defaults: by imposing rigid rules requiring banks to post collateral against not only the debts the bank has to the CCP, but against the debts the bank could potentially have to the CCP. CCPs demand liquid assets as collateral. Therefore, high market volatility or a crash could cause CCPs to make big margin calls on banks in order to protect themselves, draining liquidity from the banking system just when it needs it most. And that could cause some banks to default on their other short-term debts, driving them into bankruptcy essentially in sacrifice to the CCP.

Pirrong also worries about the impact the clearing mandate will have on members of the financial network that don’t trade derivatives at all. One of his papers shows how CCPs’ netting and margining requirements can reduce how much other creditors to banks—such as money market funds, that lend to banks by means of loans rather than derivatives—recover if the bank goes bankrupt.9

“From a systemic perspective,” Pirrong said, “viewing everybody, it’s not clear that the exposures have been reduced. Some exposures have been reduced, but other exposures have been increased.”

Duffie, with collaborator Haoxiang Zhu, have showed that CCPs don’t even always reduce total credit exposure, and can in fact increase it.10 This can happen because there’s beneficial netting between banks even when they trade directly with each other—their trades will generally result in debts directed both ways. Real-world CCPs don’t typically stand between all of the trades two counterparties have done with each other, but only some. Therefore, a CCP’s netting benefits come at the expense of netting benefits the bilateral system would otherwise have had.

“I don’t think anyone had actually considered this trade-off between multilateral netting at the CCP versus the loss of bilateral netting outside the CCP,” Duffie said to me about the conventional wisdom. While he believes that regulators were right to adopt the clearing mandate, he also believes that “their planning processes were probably not that good, in that they didn’t have the analysis to be confident that this would actually result in a significant reduction of risk before they started.”

This is still part of the problem, for those who see a problem: that the financial network is so large and complex that only comprehensive data and full-fledged modeling of it have a hope of telling us whether the mandate, not to mention other derivative regulations, are actually doing good. A scan of the recent economics literature on the topic reveals that most of it focuses on toy models that, like Allen and Gale’s, are dramatic simplifications of the real world. This is a necessary first step, since you’ve got to walk before you can run, and because data to characterize the full financial network isn’t available yet.

But for now, as Duffie’s colleague at Stanford, economist Matthew Jackson told me, “We’re still a little bit in the stone age of mapping out financial networks. A lot of people realize that this is an issue and we’re not equipped yet with the tools to really do a good job so we’re confident to say we’ve really got this under control … That’s the really frightening part.”

Actually, the situation is even trickier than that, because even once all the data and models we could want come online, there will still be trade-offs that science alone can’t settle. As Jackson pointed out, for example, “Which network is optimal depends on what kind of shock you are hitting it with … Something could be really robust to lots of small variations and then be a disastrous network when it comes to a big financial meltdown of a large firm.”

Then there’s the one thing that every economist I spoke to agreed was the elephant in the room: The risk that CCP itself fails.

Hub failure is the Achilles heel of hub-and-spoke networks. It’s the reason why worker bees swarm to protect their queen, why biologist Jordi Bascompte has called for hub species in pollination networks to receive high conservation priorities,11 why soldiers have patrolled Grand Central Terminal since 9/11, and why CCPs are required by regulators to collect collateral.

CCPs have failed in the past, but only in smaller markets.12 Now that they are at the center of the world’s largest market, Allen told me, “it makes the probability of a crisis due to that kind of systemic risk lower, but if such a crisis were to occur it would be much, much more severe.”

In other words, CCPs put all the market’s eggs in one basket.

Duffie doesn’t like that metaphor (“well that’s not well informed mathematically … because of netting”), and he points out that the failure of one big node is not necessarily worse than if many small nodes fail. What’s most important, he says, is whether regulators have made the likelihood of a CCP’s failure “sufficiently small” and second, whether they “have a method that’s reasonable for treating a failing CCP.”

Duffie paused for what felt like an ominous moment before adding:

“They don’t have one yet.”

That may sound familiar. It’s essentially the same situation we had going into 2008, with respect to big banks and other financial companies. That led to the ad hoc bailouts of Bear-Stearns and AIG and the chaos that surrounded Lehman’s collapse.

So, is there any hope that network science will help safeguard the world against another financial calamity? Possibly. But if there is, it will only be with an assist from Mark Twain’s corollary: “Put all your eggs in the one basket and—WATCH THAT BASKET.”13

Bob Henderson studied physics, worked on Wall Street, and is now an independent writer focused on science and finance.

References

1. Yellen, J.L. “Interconnectedness and Systemic Risk: Lesson from the Financial Crisis and Policy Implications.” Speech given at the American Economic Association/American Finance Association Joint Luncheon, San Diego (2013).

2. Triennial Central Bank Survey of foreign exchange and derivatives market activity in 2013.

3. The World Bank. Stocks traded, total value (% of GDP).

4. Sifma. Statistics and data pertaining to financial markets and the economy.

5. G20 Leaders Statement: The Pittsburgh Summit. University of Toronto (2009).

6. Financial Stability Board, OTC Market Derivatives Reforms, Tenth Progress Report on Implementation (2015).

7. Allen, F. & Gale, D. Financial contagion. Journal of Political Economy 108, 1-33 (2000).

8. Haldane, A.G. “Rethinking the Financial Network.” Speech given at the Financial Student Association, Amsterdam (2009).

9. Pirrong, C. A bill of goods: central counterparties and systemic risk. Journal of Financial Market Infrastructures 2 (2014).

10. Duffie, D. & Zhu, H. Does a central clearing counterparty reduce counterparty risk? The Review of Asset Pricing Studies 1, 74-95 (2011).

11. Olesen, J.M., Bascompte, J., Dupont, Y.L., & Jordano, P. The modularity of pollination networks. Proceedings of the National Academy of Sciences 104, 19891-19896 (2007).

12. Alloway, T. A glimpse at failed central counterparties. Ftalphaville.ft.com (2011).

13. Twain, M. Pudd’nhead Wilson Charles L. Webster & Company, New York, NY (1894).