Stakeholders in the cryptocurrency industry have asked Binance to reveal the identity of the government officials who asked for bribes.

The stakeholders also demanded that Binance provide evidence of its bribery claims.

Local cryptocurrency stakeholders told Cointelegraph that the bribery allegation from Binance could harm the country’s reputation if not managed well.

Rume Ophi, the Executive Secretary of the Stakeholders in Blockchain Technology Association of Nigeria, said the representative of the Nigerian Securities and Exchange Commission showed willingness to support the crypto industry during a May 6 meeting.

However, Ophi cautioned about the potential harm Binance could cause to the government’s reputation and Nigeria’s crypto industry.

He emphasized the importance of Binance revealing specific details and urging the identification of individuals involved in the alleged bribery attempt to substantiate the claim and enable authorities to address any wrongdoing, thus safeguarding Nigeria’s international image.

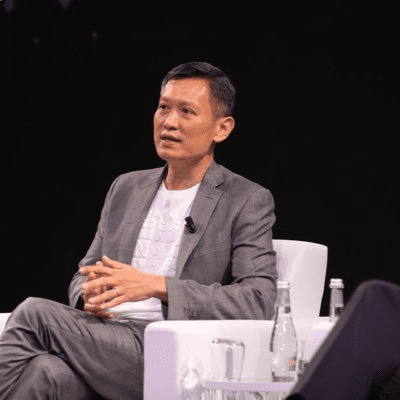

On May 7, Binance CEO, Richard Teng provided a detailed explanation regarding the detention of Tigran Gambaryan, a former IRS agent who led Binance’s financial crime compliance team.

Teng stated that unidentified individuals approached Binance employees and proposed payment to settle the allegations.

Nathaniel Luz, the CEO of Flincap, expressed doubt about any Nigerian official approaching Binance but suggested that naming specific individuals would help validate its claim.

In 2023, the Nigerian SEC declared Binance Nigeria’s operations illegal, stating it was neither registered nor regulated. On Feb. 27, the Central Bank of Nigeria governor raised concerns about crypto exchanges handling illicit transactions, particularly citing “suspicious flows” at Binance.

The situation escalated when Nigerian officials demanded actions from Binance, including delisting the Nigerian naira and providing detailed user information, resulting in the detention of Gambaryan and Nadeem Anjarwalla.