The Central Bank of Nigeria has instructed banks in the country to impose a cybersecurity levy on transactions.

A notice from the apex bank also revealed that the levy will be implemented in two weeks.

The circular stated that under the Cybercrime (Prohibition, Prevention, etc) (amendment) Act 2024, a levy of 0.5% (0.005) is to be remitted to the National Cybersecurity Fund for specified electronic transactions.

PUNCH Online explains the meaning of the term and how to identify the cybersecurity levy charged on transactions.

It's important to understand that 0.5% is the same as 0.005 (half of 1 percent). 0.005 represents 0.5% in decimal form.

Therefore, CBN will deduct 0.5% from any transfer made in line with the specified guidelines. (see what to know)

For example, if a customer wants to transfer N10,000, they will be charged N50 for cybersecurity levy under the new CBN directive, in addition to other bank and transaction charges like VAT.

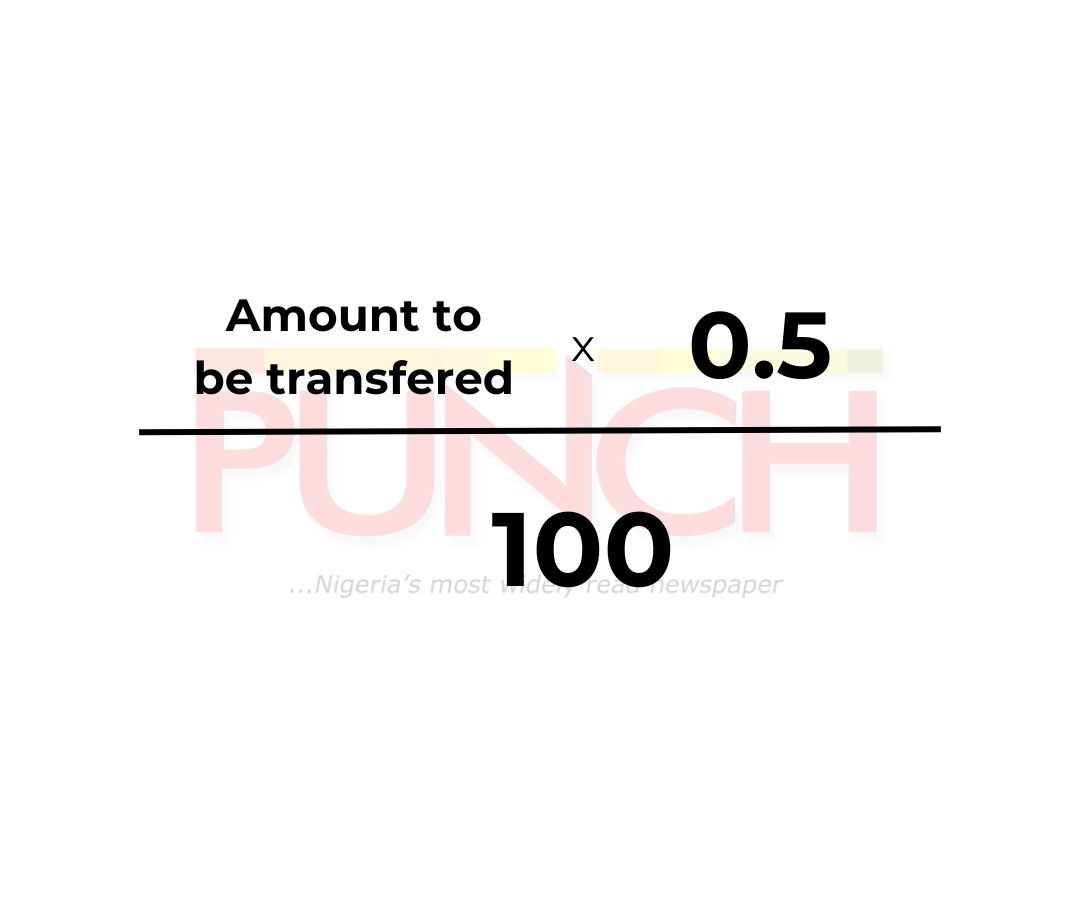

To determine the levy for a transaction, the following formulas can be used;

Formula one

The amount to be transferred is multiplied by 0.5 and then divided by 100 to find the cybersecurity levy.

or

Formula two

The amount to be transferred is multiplied by 0.005 to determine the cybersecurity levy.

However, CBN has also listed 16 banking transactions that are exempt from the new cybersecurity levy, including loan disbursements repayments and salary payments, among others. exempted from the CBN’s new cybersecurity levy including Loan disbursements repayments and Salary payments, among others.