Guaranty Trust Holding Company Plc recorded a 587.5% increase in its pre-tax profit reaching N509.3bn in the first quarter of 2024, compared to the same quarter in 2023.

This information was included in its unaudited first quarter results submitted to the Nigerian Exchange Limited.

The banking group's pre-tax profit jumped to N509.3bn, marking a 587.5% rise from N74.1bn in the corresponding period ending in March 2023.

The group's balance sheet expanded during this period, with total assets and shareholders' funds closing at N13tn and N2tn respectively.

GTCO revealed that its net loan book grew by 21.9% from N2.48tn in December 2023 to N3.02tn in March 2024, while deposit liabilities surged by 26.0% from N7.55tn in December 2023 to N9.51tn in March 2024.

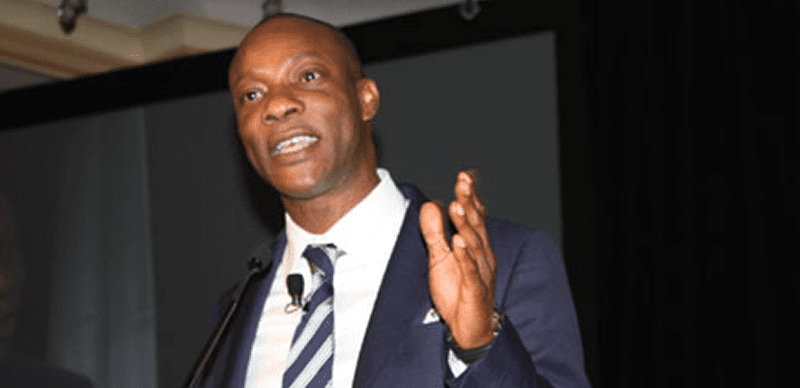

In response to the results, Mr Segun Agbaje, the Group Chief Executive Officer of Guaranty Trust Holding Company Plc, commented, "Our first quarter results demonstrate the increasing value of our offerings across all our business sectors through the Holding Company Structure. From Banking and Payments to Funds Management and Pension, we are well-positioned to effectively compete and meet all our customers' needs within a unified, flourishing financial ecosystem. Despite the challenging operating environment, we achieved strong performance, experiencing significant growth across all financial and non-financial metrics, and we are on track to meet our full-year targets."

Agbaje added, "Looking forward, we will continue to concentrate on strengthening our relationships with our loyal customers, facilitating support for individuals, businesses, and communities through our established free business platforms, as well as through innovative products and services. We have confidence in our ability to lead the future of financial services in Africa and are unwavering in our commitment to excellence while delivering long-term value to all stakeholders."

In its 2023 annual reports, the Group posted a pre-tax profit of N609.3bn, reflecting a 184.5% increase over the N214.2bn recorded in the previous year ended December 2022.

Additionally, to meet the new capital requirements set by the Central Bank of Nigeria, GTCO has announced its intention to raise up to $750m through the issuance of securities such as ordinary shares, preference shares, convertible and non-convertible notes, bonds, or any other instruments in the Nigerian and/or international capital markets.