Netflix is set to announce its first quarter results for 2024 on April 18. Previously, we discussed how the streaming service made progress in comparison to other companies at the end of last year by increasing the number of its original titles. During the same period, platforms worldwide reduced the production of new original series.

Netflix capitalized on this temporary advantage over its competitors and reported impressive earnings, surpassing the expected number of subscribers. Will this trend continue into 2024, further solidifying Netflix's dominance? Using Parrot Analytics’ Content Panorama gives us a more detailed understanding of how Netflix’s collection of content compares to the competition.

Both Netflix and Amazon Prime Video have some of the largest collections of international content in the U.S. As global streaming services that create original content for audiences worldwide, both Amazon and Netflix are able to offer this content to their U.S. subscribers.

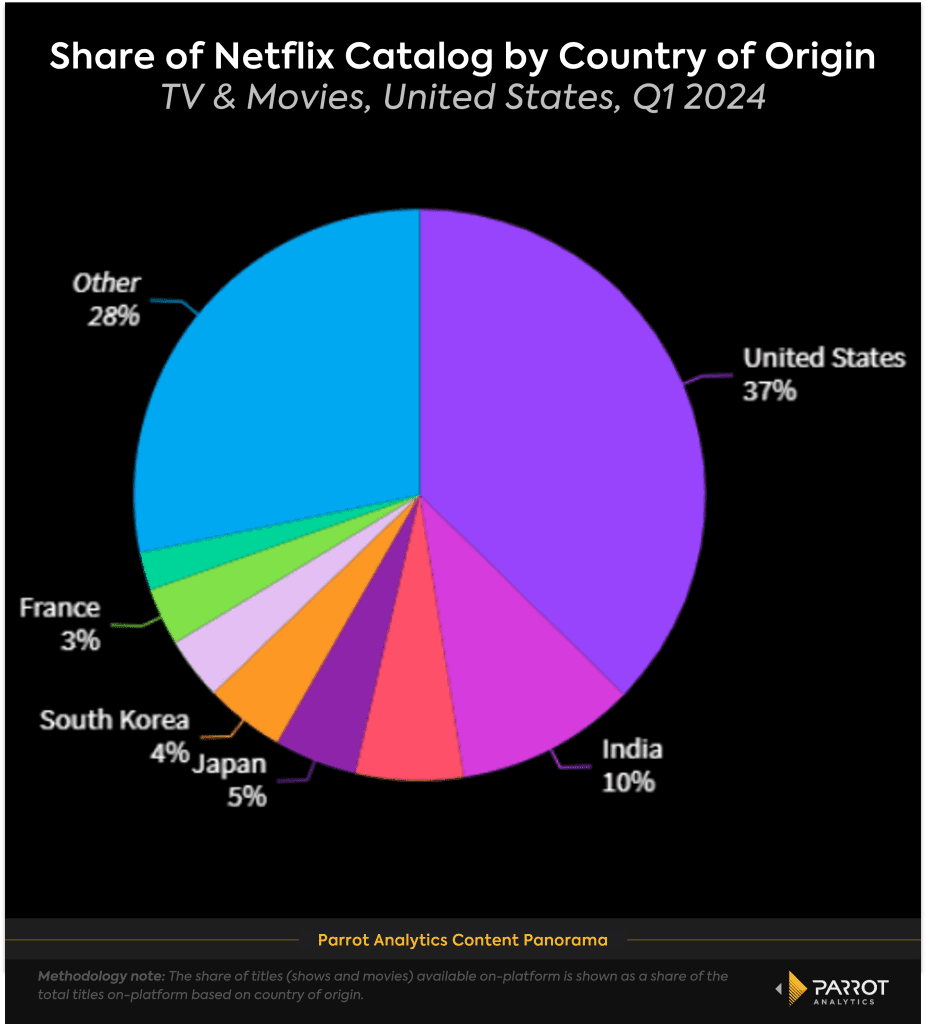

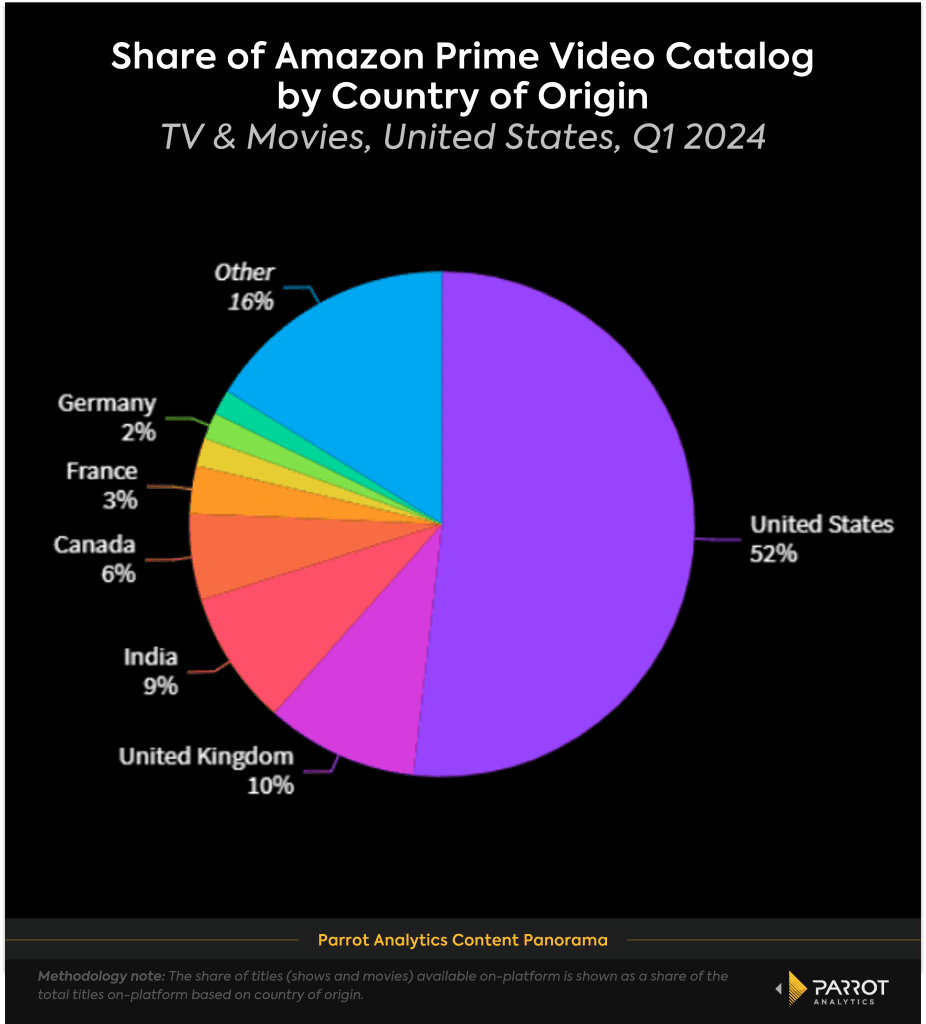

This is where we notice some significant differences in the types of content available on the two platforms. While both platforms are leading in terms of the quantity of international content they provide to U.S. audiences, Netflix has a much larger portion of international titles available for streaming in the U.S. A majority of shows and movies available on Prime Video originate from the U.S.

For U.S. viewers looking for a show or movie from India, Netflix has the widest selection. 10% of the titles available on Netflix in the U.S. are from India. While Netflix may have an advantage in terms of the quantity of these shows, Amazon Prime Video performs admirably with some of the most popular Indian titles with U.S. audiences.

Prime Video is an attractive streaming service for American fans of British culture, with 10% of its titles originating from the U.K. (although it might have to compete with BritBox for this audience). Netflix's commitment to content from East Asia is evident, with Japan and South Korea accounting for 5% and 4% of titles on the platform respectively. Neither of these markets ranked in the top 8 in terms of the number of titles on Prime Video.

While comparing these platform collections provides insights into their different strategies and competitive strengths, to truly understand which platform is best positioned to meet the interest of audiences in foreign content, we need to examine demand trends to see what audiences desire and which types of content are becoming more popular.

Christofer Hamilton is a senior insights analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.